Estudios de Caso

Helping clients achieve success with 1TCC®

Successful Client Testimonial

“The feedback received was extremely positive and our Top Finance Management recognizes the professionalism of 1TCC and the expertise of all members involved […] I firmly believe that this is the right path forward and I’m looking to develop a strong partnership in this new business endeavor […] I value the relationship we have built with you so far and look forward to collaborating further.”

Executive Industry Leader

Large European Automotive Conglomerate

Successful Client Testimonial

“The feedback received was extremely positive and our Top Finance Management recognizes the professionalism of 1TCC and the expertise of all members involved […] I firmly believe that this is the right path forward and I’m looking to develop a strong partnership in this new business endeavor […] I value the relationship we have built with you so far and look forward to collaborating further.”

Executive Industry Leader

Large European Automotive Conglomerate

Scenario 1

EV Battery Manufacturer

36%

of Working Capital

freed up to Liquidity*

$400M

Unlocked from Excess Inventory*

33%

Reduction in Delayed Supplier Payments*

Pain Points

Facing significant cash flow constraints due to supply chain inefficiencies, causing excess inventory and delayed supplier payments. This inflates NWC (Net Working Capital) of $550M and limited financial flexibility, causing operational bottlenecks and limited growth potential.

Objective

Optimizing working capital and improving liquidity to be able to invest in business goals and growth projects and reduce operational disruptions to strengthen supplier relationships.

Approach

1TCC demonstrates how its fully integrated VMI (Vendor Managed Inventory) platform could provide capital-efficient solutions to combat supply chain disruptions by procuring and holding inventory at the supplier’s preferred locations, ensuring on-demand availability and reducing inventory levels without disrupting business processes.

Result

Net Working Capital Impact with TCC

- Would unlock $400M from excess inventory and $200M from delayed supplier payments.

- NWC would drop from $550M to $350M, freeing up $200M in liquidity.

- With this freed capital, the manufacturer could reinvest in strategic growth initiatives, strengthen supplier relationships through accelerated payments, and be positioned for long-term resilience to future supply chain challenges.

Scenario 1

EV Battery Manufacturer

36%

of Working Capital freed up to Liquidity*

$400M

Unlocked from Excess Inventory*

33%

Reduction in Delayed Supplier Payments*

Pain Points

Facing significant cash flow constraints due to supply chain inefficiencies, causing excess inventory and delayed supplier payments. This inflates NWC (Net Working Capital) of $550M and limited financial flexibility, causing operational bottlenecks and limited growth potential.

Objective

Optimizing working capital and improving liquidity to be able to invest in business goals and growth projects and reduce operational disruptions to strengthen supplier relationships.

Approach

1TCC demonstrates how its fully integrated VMI (Vendor Managed Inventory) platform could provide capital-efficient solutions to combat supply chain disruptions by procuring and holding inventory at the supplier’s preferred locations, ensuring on-demand availability and reducing inventory levels without disrupting business processes.

Result

Net Working Capital Impact with TCC

- Would unlock $400M from excess inventory and $200M from delayed supplier payments.

- NWC would drop from $550M to $350M, freeing up $200M in liquidity.

- With this freed capital, could reinvest in strategic growth initiatives, strengthen supplier relationships through accelerated payments, and be positioned for long-term resilience to future supply chain challenges.

Scenario 2

European Medical Device Manufacturer

90 days

CCC improvement*

Efficiency & relationships

Pain Points

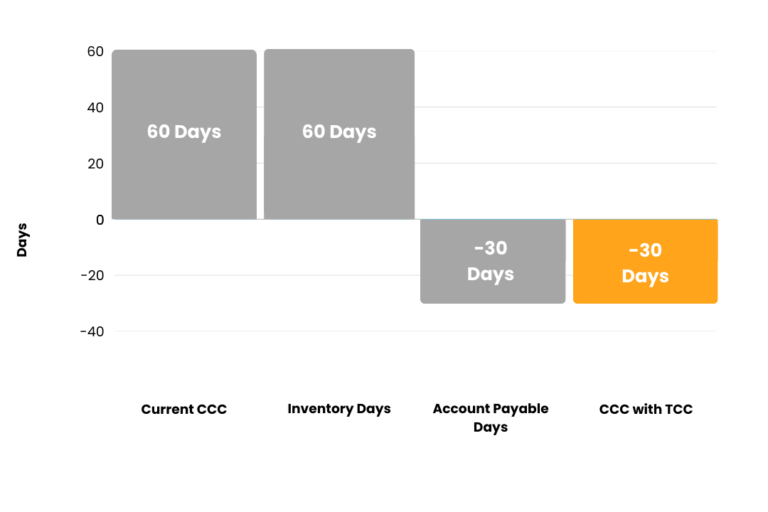

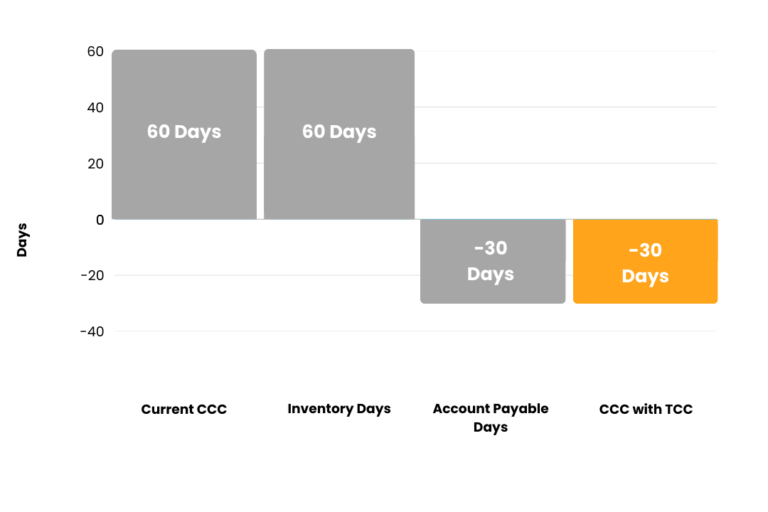

Struggled with a 60-day CCC (Cash Conversion cycle) due to inefficient inventory management of raw materials, slow delivery schedules, and suboptimal supplier payment processes.

The high CCC (Cash Conversion cycle) resulted in cash tied-up in working capital, higher financing costs to fund operations and operational inefficiencies.

Objective

Shortening CCC (Cash Conversion cycle) through better inventory management, improving credit terms, or optimizing supplier payment schedules to improve cash flow.

Approach

The 1TCC platform optimizes cash flows in inventory and payables management by holding inventory until needed for production, reducing Days Inventory Outstanding (DIO) and improving inventory management. Additionally, 1TCC accelerates payments to suppliers and extends payment terms to manufacturers, increasing Days Payables Outstanding (DPO), which reduces the Cash Conversion Cycle (CCC) and enhances cash flow

Result

Cash Conversion Cycle Impact with TCC

- CCC would improve by 90 days, moving from 60 days to -30 days.

- With this freed capital, the manufacturer could reinvest in strategic growth initiatives, strengthen supplier relationships through accelerated payments, and be positioned for long-term resilience to future supply chain challenges.

Scenario 2

European Medical Device Manufacturer

90 days

Cash Conversion Cycle improvement*

Efficiency & relationships

Pain Points

Struggled with a 60-day CCC (Cash Conversion Cycle) due to inefficient inventory management of raw materials, slow delivery schedules, and suboptimal supplier payment processes.

The high CCC (Cash Conversion Cycle) resulted in cash tied-up in working capital, higher financing costs to fund operations and operational inefficiencies.

Objective

Shortening CCC (Cash Conversion Cycle) through better inventory management, improving credit terms, or optimizing supplier payment schedules to improve cash flow.

Approach

The 1TCC platform optimizes cash flows in inventory and payables management by holding inventory until needed for production, reducing Days Inventory Outstanding (DIO) and improving inventory management. Additionally, 1TCC accelerates payments to suppliers and extends payment terms to manufacturers, increasing Days Payables Outstanding (DPO), which reduces the Cash Conversion Cycle (CCC) and enhances cash flow

Result

Cash Conversion Cycle Impact with TCC

- CCC would improve by 90 days, moving from 60 days to -30 days.

- With this freed capital, could reinvest in strategic growth initiatives, strengthen supplier relationships through accelerated payments, and be positioned for long-term resilience to future supply chain challenges.

Scenario 3

High Tech Manufacturer

$200M

Reduction in short term debt*

26%

Improvement in

Debt-to-Equity Ratio*

35%

Improvement in Net

Debt-to-EBITDA Ratio*

Pain Points

Relied heavily on short-term debt to fund inventory procurement.

$800 million in working capital loans that led to poor leverage ratios, including a Debt-to-Equity ratio of 0.46x and a Debt-to-Total Capital ratio of 0.33x.

The excessive debt limited their financial flexibility, increasing financial risk, lowering creditworthiness, straining cash flow, and increasing operational risk.

Objective

Improving risk profile, cash flows, and leverage ratios by optimizing working capital to reduce short-term debt.

Approach

The 1TCC platform offers capital-efficient supply chain solutions that improve liquidity without disrupting existing business processes by procuring and holding inventory for customers, reducing debt needs for inventory funding, improving leverage ratios, and making the balance sheet leaner and more appealing to lenders and stakeholders.

.

Debt Impact with TCC

- Reliance on short-term debt to fund inventory would reduce from $800M to $600M, improving financial stability and lowering financial risk.

- Would improve Debt-to-Equity ratio from 0.46x to 0.34x, boosting attractiveness to investors and creditors, and enabling reinvestment in growth projects for long-term sustainability.

Result

Improved Leverage with TCC

- Improved leverage ratios as Debt-to-Total Capital ratio would improve from 0.33x to 0.26x and Net Debt-to-EBITDA ratio from 1.32x to 0.86x, demonstrating stronger earnings relative to debt obligations.

- Increased creditworthiness could attract new investors and provide greater financial flexibility for future growth.

Scenario 3

High Tech Manufacturer

$200M

Reduction in short term debt*

26%

Improvement in

Debt-to-Equity Ratio*

35%

Improvement in Net

Debt-to-EBITDA Ratio*

Pain Points

Relied heavily on short-term debt to fund inventory procurement.

$800 million in working capital loans that led to poor leverage ratios, including a Debt-to-Equity ratio of 0.46x and a Debt-to-Total Capital ratio of 0.33x.

The excessive debt limited their financial flexibility, increasing financial risk, lowering creditworthiness, straining cash flow, and increasing operational risk.

Objective

Improving risk profile, cash flows, and leverage ratios by optimizing working capital to reduce short-term debt.

Approach

The 1TCC platform offers capital-efficient supply chain solutions that improve liquidity without disrupting existing business processes by procuring and holding inventory for customers, reducing debt needs for inventory funding, improving leverage ratios, and making the balance sheet leaner and more appealing to lenders and stakeholders.

.

Debt Impact with TCC

- Reliance on short-term debt to fund inventory would reduce from $800M to $600M, improving financial stability and lowering financial risk.

- Would improve Debt-to-Equity ratio from 0.46x to 0.34x, boosting attractiveness to investors and creditors, and enabling reinvestment in growth projects for long-term sustainability.

Improved Leverage with TCC

- Improved leverage ratios as Debt-to-Total Capital ratio would improve from 0.33x to 0.26x and Net Debt-to-EBITDA ratio from 1.32x to 0.86x, demonstrating stronger earnings relative to debt obligations.

- Increased creditworthiness could attract new investors and provide greater financial flexibility for future growth.

Scenario 4

Aerospace Manufacturer

3x

Increase in Inventory Turnover*

13%

Improvement in Asset Turnover*

50%

Increase in Payables Turnover*

Pain Points

Experiencing inefficiencies in key operational areas, reflected in poor Inventory Turnover (0.5x), Asset Turnover (0.30x), and Payables Turnover (0.5x) which w ere increasing costs and hindering profitability

Objective

Improve operational efficiency, increase profitability, and reduce costs by optimizing supply chain processes.

Approach

The 1TCC platform addresses such inefficiencies by implementing more efficient inventory management, better asset utilization, and more streamlined payables processes, enabling the manufacturer to reduce unnecessary costs and improve supplier relationships.

Result

Improved Leverage with TCC

- 1TCC would reduce the inventory and payables on the balance sheet.

- This could increase the Inventory Turnover from 0.5x to 1.50x, Asset Turnover from 0.30x to 0.34x, and Payables Turnover from 0.50x to 0.75x.

- These improvements would reduce inventory holding costs, increase asset utilization, and strengthen supplier relationships through timely payments, enhancing profitability and efficiency in responding to market demands.

Scenario 4

Aerospace Manufacturer

3x

Increase in Inventory Turnover*

13%

Improvement in Asset Turnover*

50%

Increase in Payables Turnover*

Pain Points

Experiencing inefficiencies in key operational areas, reflected in poor Inventory Turnover (0.5x), Asset Turnover (0.30x), and Payables Turnover (0.5x) which w ere increasing costs and hindering profitability

Objective

Improve operational efficiency, increase profitability, and reduce costs by optimizing supply chain processes.

Approach

The 1TCC platform addresses such inefficiencies by implementing more efficient inventory management, better asset utilization, and more streamlined payables processes, enabling the manufacturer to reduce unnecessary costs and improve supplier relationships.

Result

Improved Leverage with TCC

- 1TCC would reduce the inventory and payables on the balance sheet.

- This could increase the Inventory Turnover from 0.5x to 1.50x, Asset Turnover from 0.30x to 0.34x, and Payables Turnover from 0.50x to 0.75x.

- These improvements would reduce inventory holding costs, increase asset utilization, and strengthen supplier relationships through timely payments, enhancing profitability and efficiency in responding to market demands.

* The information and data presented in these case studies are for illustrative purposes only. They are entirely fictional and do not reflect actual financial figures, metrics, operations, or results of any company, real or implied. This content is intended solely to explain our business model.